Lately, PSU banks have been in the news a lot. There’s a buzz now; it’s not just about interest rates or earnings. A change. A kind of energy that feels almost electric. Whether it’s the government pushing public sector banks to find hidden value or unexpected market rallies caused by geopolitical news, one thing is clear: these old-timers are now very valuable.

And what is at the heart of it all? State Bank of India (SBI), Punjab National Bank (PNB), Bank of Baroda (BoB), and Canara Bank are the four main banks. Each one has its own quirks, fans, and drama. Let’s take this apart. Who is the biggest? Who’s the favorite for dividends? And who has made investors the happiest over the long term?

Market Cap: Who’s Got the Muscle?

Let’s start with the basics. Market cap is the big number, share price times the number of shares. It tells you, more or less, how “big” a company is in market terms.

No contest here: SBI is a giant. Towering over the others, it’s the biggest public sector bank in India by a long shot. Its market value is more than six times that of PNB and nearly seven times that of Canara Bank.

That kind of size brings stability. SBI is woven into every part of the financial system. It anchors indexes. It’s the safe bet in many portfolios. But with size comes a little inertia; big ships don’t turn fast. SBI moves with confidence, not with flair.

The others? Smaller, more agile. They don’t have SBI’s bulk, but they do have room to sprint. And sprint they have.

Dividend Payouts: Who’s Sharing the Wealth?

Now, let’s talk money in hand. Dividend payouts are where the bank shares its profits directly with you, the shareholder. And guess what? This year brought some surprises.

- SBI handed out ₹15.90 per share. Sounds huge, right?

- PNB gave ₹2.90 per share. Not massive, but steady.

- BoB clocked in at ₹8.35 per share.

- Canara dished out ₹4.00 per share.

On paper, SBI looks like the most generous. But here’s the twist: what matters more is the dividend yield, the payout as a percentage of the stock’s price.

If you crunch those numbers, you’ll find something surprising. BoB and Canara offer better yields than SBI. Why? Because their stock prices are lower, those dividends are relatively more rewarding.

So, while SBI might hand you the biggest cheque in rupees, BoB and Canara give you more bang for your buck, literally.

Share Price: Who’s Affordable?

Let’s say you’re shopping for bank stocks. Here’s what they cost per share right now:

- SBI: ₹808

- PNB: ₹110

- BoB: ₹237

- Canara: ₹112

SBI is the priciest. But don’t be fooled; this doesn’t mean the others are “cheaper” in value terms. Price per share isn’t the same as valuation. You’re not buying less quality with a lower cost; you’re just buying a smaller slice.

Still, the entry point matters. If you’re a retail investor with ₹10,000 to spare, you can buy 90 shares of PNB or 12 of SBI. That accessibility often pulls in new investors to the lower-priced PSU names.

Returns: Who’s Delivering the Goods?

Okay, here’s the meat and potatoes: how have these banks performed?

SBI

Short-term? Not flashy. Slight dips in the last few weeks and months. But over time? Oh, it shines.

- 1-Year: +5.6%

- 3-Year: +65.6%

- 5-Year: +313%

- 10-Year: +198%

Yes, you read that right: triple your investment in five years. That’s the kind of consistency long-term investors dream of. SBI isn’t exciting day-to-day, but it’s a powerhouse over the long haul.

PNB

Now here’s a plot twist.

- 1-Year: -7.8%

- 10-Year: -24%

Ouch. But wait…

- 2-Year: +82%

- 3-Year: +255%

- 5-Year: +214%

See that? PNB went through the wringer but staged a massive comeback. Anyone who bet on it a few years ago? Laughing all the way to the bank. It’s the underdog story with a surprise punch.

Bank of Baroda (BoB)

Now we’re talking fireworks.

- 1-Year: -9%

- 3-Year: +140%

- 5-Year: +539%

That’s not a typo, over 500% growth in five years. Bob went from quiet to a breakout performer. The 10-year return sits around 54%, so clearly, the recent years have been the boom era.

Canara Bank

Very similar story to BoB.

- 1-Year: -2%

- 3-Year: +158%

- 5-Year: +435%

- 10-Year: +96%

It had its sleepy phase, sure. But lately? It’s been a rocket. Investors who caught it before takeoff have made serious gains.

The Bigger Picture: What’s Driving This?

There’s more going on here than just bank performance. The government’s policy push is playing a massive role. From urging PSU banks to IPO their subsidiaries to simplifying regulations, it’s all been geared toward unlocking hidden value.

Add to that a wave of positive sentiment: easing inflation, stable interest rates, and infrastructure spending. All this creates fertile ground for banks to grow and for their stocks to shine.

And there’s emotion, too. Retail investors are returning. Institutional players are nibbling. There’s a sense that the story of PSU banks is no longer about surviving; it’s about thriving.

So, Which Bank Should You Bet On?

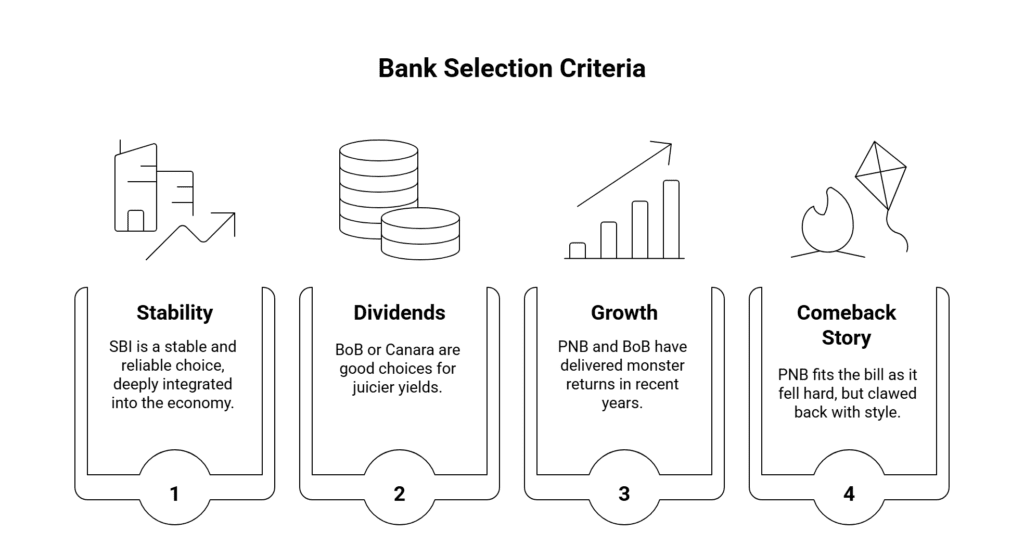

Here’s the thing: there’s no one-size-fits-all answer.

- Want stability? SBI is the obvious pick. Big, reliable, deeply integrated into the economy.

- Craving dividends? Look at BoB or Canara for those juicier yields.

- Hungry for growth? PNB and BoB have delivered monster returns in recent years.

- Looking for a comeback story? PNB fits the bill. It fell hard, but it clawed back, with style.

Your best move might be diversification; spread your chips across a few, depending on your risk appetite and investment horizon.

Because let’s face it, these banks aren’t just playing catch-up anymore. They’re reinventing themselves. And if the past few years are any indicator, they’ve still got plenty of surprises up their sleeves.

Final Thoughts

TPeople used to think that PSU banks were slow, bureaucratic beasts. Not anymore.

What now? They’re thinner. Meaner. More hungry. They’re fighting for control of the digital world, welcoming fintech, and pushing for change. The dividends are better, the returns are better, and the stories… well, they’ve never been more interesting. So, whether you’re betting on the elephant (SBI), the rebound kid (PNB), or the BoB and Canara rockets, remember this: the real power comes from knowing what you’re buying and why.

And in the world of PSU banks, what does that mean? That’s where the real money starts.