Why Wyoming? (And Why Now?)

To start, when most investors are looking for the next big thing, Wyoming isn’t the first place that comes to mind. Silicon Valley? Yes. Wall Street? Of course. Wyoming, though? Isn’t that the punchline? The worst part is that it shouldn’t be. No longer.

Because, despite appearances, the Cowboy State is quietly—and occasionally stubbornly—creating an economic narrative that combines modern innovation with old-fashioned grit. Furthermore, Wyoming offers much more than just open spaces and bison jams for investors with an eye for opportunity, particularly the kind that lurks in plain sight.

What, then, is the true engine of Wyoming’s economy? What merits your time and possibly your money? Let’s reveal.

The Big Three: Wyoming’s Economic Pillars

1. Energy: Still King (But Wearing a New Crown)

Coal, Not Dead Yet (And Maybe Never Will Be)

Well, let’s get right to the point: Wyoming’s main source of income is coal. For decades. The Basin of the Powder River? In a sense, it’s the Fort Knox of American coal. The problem is that coal is no longer its golden child. The industry is now on the defensive due to environmental pressures, changing regulations, and the growth of renewable energy sources.

But don’t count it out. Not yet. Wyoming’s coal sector is scrappy. There’s a ton of investment (and, honestly, hope) riding on carbon capture tech; think Wyoming Integrated Test Center, where they’re trying to make coal cleaner, smarter, and, well, future-proof. If you’re the kind of investor who likes a challenge (and maybe a little risk), this is a space to watch. Or, you know, jump in with both boots.

Oil & Gas, Boom, Bust, Repeat (But Always Bouncing Back)

Funny thing is, oil and gas in Wyoming is like that friend who always bounces back, no matter how many times life knocks them down. Prices tank? They pivot. New drilling tech? They’re on it. The state’s basins, Powder River, Green River, and Big Horn, are still pumping out black gold and natural gas, and the infrastructure is solid.

But here’s where it gets interesting: midstream investments (pipelines, storage, processing) are kind of the unsung heroes. They’re less volatile, more stable, and, if I’m honest, a little underappreciated. Plus, with the world’s energy appetite not exactly shrinking, there’s always a play here for the patient investor.

Wind & Renewables, The New Frontier (And It’s Blowing Up)

Now, if you want to talk about a sector with real momentum, wind energy is Wyoming’s rising star. Those endless plains? Turns out, they’re perfect for wind farms. The state’s already home to some of the biggest wind projects in the country, and with new transmission lines (like the TransWest Express) in the works, Wyoming’s about to become a major exporter of clean energy.

Solar’s still in its awkward teenage years here, but give it time. And don’t sleep on green hydrogen, there’s buzz about using all that wind power to make hydrogen fuel. It’s early days, but for investors who like to get in before the crowd, this is the kind of “whisper stock” opportunity you brag about later.

2. Tourism & Outdoor Recreation: The Wild Card

Yellowstone, Grand Teton, and the Magic of the Wild

Let’s be real: if you’ve ever been to Wyoming, you know the scenery is next-level. Yellowstone and Grand Teton National Parks? They’re not just pretty; they’re economic engines. Millions of visitors, billions in spending, and a ripple effect that touches everything from hotels to fly-fishing guides.

But here’s the twist: post-pandemic, people are craving wide-open spaces. Remote work means you can Zoom from a cabin in Jackson Hole just as easily as from a high-rise in Manhattan. Investors are snapping up boutique hotels, glamping resorts, and adventure tour companies. The outdoor recreation industry, hiking, skiing, mountain biking, you name it, is booming.

Small Towns, Big Dreams

It’s not just the big-name parks. Towns like Cody, Sheridan, and Laramie are reinventing themselves as hubs for art, culture, and (believe it or not) tech startups. There’s a “new West” vibe; think craft breweries, farm-to-table restaurants, and co-working spaces with mountain views. If you’re looking for real estate plays or want to back local entrepreneurs, this is fertile ground.

3. Agriculture & Ranching: The Quiet Backbone

Cattle, Hay, and a Whole Lot of Land

Wyoming’s ag sector doesn’t make headlines, but it’s steady as a rock. Cattle ranching is the big dog; Wyoming beef is a brand in itself. Hay, barley, sugar beets, and wheat round out the mix. The state’s dry climate and high elevation make for unique challenges (and flavors), but also some of the best grass-fed beef you’ll ever taste.

Ag-Tech and Sustainability: The Next Chapter

Here’s where it gets interesting for investors: ag-tech is starting to take root. Think drone monitoring, precision irrigation, and sustainable grazing practices. There’s a push for organic and specialty crops and a growing market for farm-to-table supply chains. If you’re into ESG investing, Wyoming’s ag sector is ripe for innovation.

Emerging Sectors: Where the Smart Money’s Looking

Data Centers & Tech: Silicon Prairie?

You might not expect it, but Wyoming is quietly becoming a haven for data centers. Why? Cheap land, a cool climate (less money spent on cooling servers), and, get this, some of the lowest electricity rates in the country. Plus, the state’s pro-business tax structure (no corporate or personal income tax) is a huge draw.

Big players like Microsoft have already set up shop, and there’s room for more. Blockchain and crypto companies are sniffing around, too, thanks to Wyoming’s forward-thinking digital asset laws. If you’re a tech investor, this is a “watch this space” situation.

Manufacturing & Value-Added Processing

It’s not Detroit, but Wyoming’s manufacturing sector is growing, especially in value-added ag products (think cheese, jerky, and craft spirits) and components for the energy industry. The state’s location, smack dab between the West Coast and the Midwest, makes it a strategic spot for distribution and logistics.

The Wyoming Advantage: Why Investors Are Paying Attention

Business-Friendly Climate (No, Really)

Let’s talk taxes. Or, more accurately, the lack thereof. Wyoming has no corporate income tax. No personal income tax. Property taxes are low. The regulatory environment? Streamlined and predictable. For investors, that means more of your returns stay in your pocket.

Incentives & Support

The state isn’t shy about courting investment. There are grants, low-interest loans, and workforce training programs for businesses willing to set up shop. The Wyoming Business Council is basically a concierge service for investors, helping you navigate permits, find sites, and connect with local partners.

Quality of Life (Because It Matters)

Here’s something you can’t put a price on: quality of life. Wyoming’s got clean air, low crime, and a sense of community that’s hard to find elsewhere. For investors looking to relocate or attract talent, this is a big selling point.

Risks, Challenges, and the Road Ahead

Economic Volatility

Let’s not sugarcoat it: Wyoming’s economy is still tied, in a big way, to the boom-and-bust cycles of energy. Diversification is happening, but it’s a work in progress. If you’re risk-averse, you’ll want to hedge your bets.

Workforce & Infrastructure

The state’s small population means a limited labor pool. Infrastructure, especially broadband in rural areas, is improving, but it’s not Silicon Valley (yet). If you’re planning a big tech play, factor this in.

Environmental & Regulatory Shifts

Energy investors, take note: the regulatory landscape is shifting, especially around fossil fuels. Wyoming’s leaders are pro-business, but federal policies can change the game. Stay nimble.

Investor Playbook: Where to Put Your Money

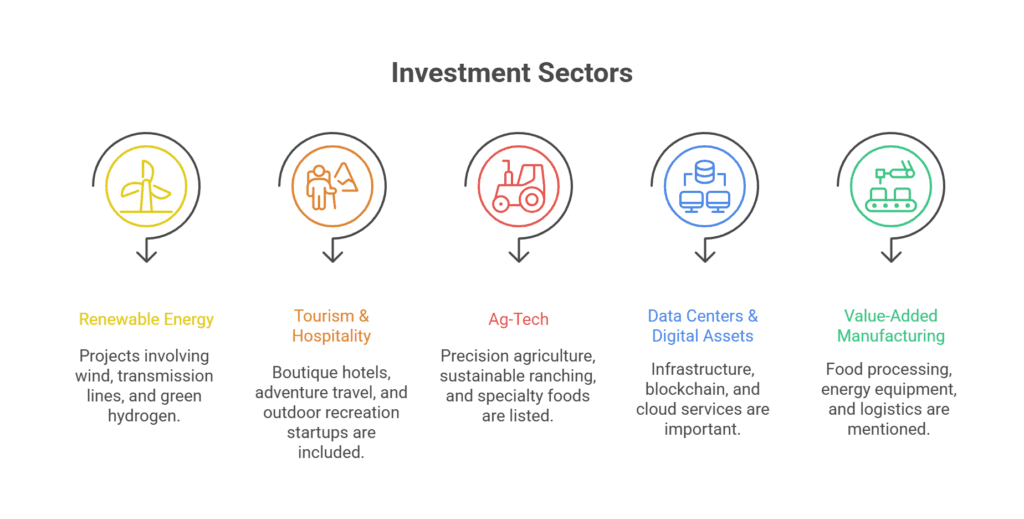

Hot Sectors for 2025 and Beyond

- Renewable Energy: Wind, transmission lines, and green hydrogen projects.

- Tourism & Hospitality: Boutique hotels, adventure travel, and outdoor recreation startups.

- Ag-Tech: Precision agriculture, sustainable ranching, and specialty foods.

- Data Centers & Digital Assets: Infrastructure, blockchain, and cloud services.

- Value-Added Manufacturing: Food processing, energy equipment, and logistics.

Tips for Getting Started

- Partner Local: Wyomingites value relationships. Find local partners, attend community events, and build trust.

- Do Your Homework: Each county has its own quirks, zoning, incentives, and workforce. Dig deep.

- Think Long-Term: Wyoming rewards patience. The biggest wins go to those who stick around.

Final Thoughts: Is Wyoming Right for You?

Is Wyoming going to be the next big thing for investors? Perhaps. Perhaps not. It depends on your willingness to see beyond the obvious, your risk tolerance, and your appetite for adventure. However, there is no denying that the state is evolving. Quick. And the people who see the potential before others do, and who enter the market early, stand to benefit the most.

Wyoming’s economy is a blend of old and new, grit and innovation, and tradition and transformation. It’s not for everyone. But for the right investor? It’s a goldmine. Give it a try. You might just fall in love with the place and the returns.

Quick Reference: Wyoming’s Key Investment Sectors

Energy

- Coal (with a twist: carbon capture, rare earths)

- Oil & Gas (E&P, midstream, services)

- Wind & Renewables (wind farms, transmission, green hydrogen)

Tourism & Recreation

- National parks, adventure travel, boutique hospitality

- Outdoor gear, local experiences, and real estate

Agriculture

- Cattle, hay, specialty crops

- Ag-tech, organic, value-added processing

Emerging Industries

- Data centers, blockchain, digital assets

- Manufacturing, logistics, food processing