Dubai’s new “First Home Buyer” program, which started on July 2, 2025, aims to make it easier for people to buy homes and increase homeownership among residents. The Dubai Land Department (DLD) and the Dubai Department of Economy and Tourism are working together on the program, which gives first-time buyers special benefits. These include getting first dibs on new off-plan and launch projects, getting better prices on units (up to AED 5 million in value), flexible payment plans, low-rate mortgages (up to 18 years), and waived or interest-free DLD registration fees. The goal is to bring end-users (not just investors) into the market, in line with Dubai’s Real Estate Strategy 2033 and Year of Community 2025, which aim to boost homeownership, strengthen communities, and support the economy. One official said that this step is “to make the dream of owning a home a reality… [and] make Dubai stronger and more resilient

Requirements and Eligibility

Anyone who lives in the UAE (nationals and expatriates) and is 18 years old or older can apply for the program. They must not have owned a freehold residential property before. To take part, buyers must have a valid Emirates ID and apply through the DLD website or the Dubai REST app. DLD clearly states that properties sought under the scheme must be freehold apartments or villas priced below AED 5 million. The basic requirements are that the buyer must be an adult, a resident of Dubai, and a first-time buyer. Once a buyer completes a purchase under the program, they lose their “first-time buyer” status and cannot reapply. The initiative does not set a minimum income level; instead, each participating bank decides whether or not to give financing on a case-by-case basis. In practice, officials have said that they will lower income requirements to include people with middle incomes (around AED 15,000 to 20,000 per month) so they can afford to buy a house that costs less than AED 1 million. homes

Salary Criteria and Adjustments

While the program imposes no formal minimum salary, participating lenders have discretion over individual loan approval. Industry sources note that banks will aim to accommodate a wide range of incomes. Developers involved in the scheme say they will make the “salary criteria…as generous as possible” to include buyers earning roughly AED 15k, 20kIn effect, the city encourages residents with modest salaries to consider affordable homes (around AED 1 million) under this plan Dubai’s goal is explicitly to broaden the pool of eligible buyers, giving lower‑ to middle-income residents a chance at homeownership.

Key Stakeholders and Partners

The initiative is a joint effort of the Dubai Land Department (DLD) and the Dubai Department of Economy and Tourism (DET DLD’s Registration Sector (led by CEO Majid Al Marri) and other senior officials have overseen the launch. More than 13 leading developers have signed up to offer special terms, including Emaar, Nakheel, DAMAC, Azizi, Danube, Meraas, Wasl, Palma, Binghatti, Ellington, and Majid Al Futtaim properties. Builders will reserve inventory for first-time buyers and provide discounts or fixed preferential prices on select units. Several major banks are also participating: Emirates NBD, Emirates Islamic, Mashreq, Dubai Islamic Bank, and Commercial Bank of Dubai. They have developed tailored mortgage packages (including low down-payments and long tenors) and even offer interest-free installment plans for DLD registration fees. In addition, leading real-estate platforms, Bayut, Property Finder, and Dubizzle, and local brokers have joined the effort to help residents sign up and navigate the

Benefits and Implications for Buyers

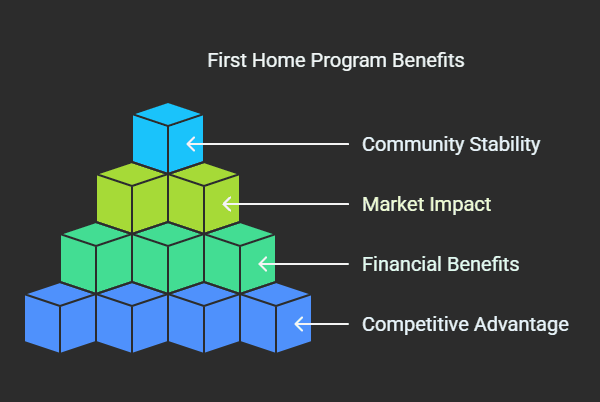

By design, the First Home program gives buyers a competitive advantage. Qualified applicants receive discounts and fixed prices that shield them from market appreciation during construction have committed to very low interest rates and extended loans (up to 18 years) to reduce monthly payments. In the words of DLD’s Khalid al Shibani, buyers will enjoy “good financing offers… with preferential prices. You will have additional benefits like discounts from developers. Property experts expect this to significantly expand demand from end-users. For example, RiseUp consultancy founder Aakarshan Kathuria predicts “more mid-income salaried individuals becoming first-time homeowners,” driven by access to the lowest available financing ratesDevelopers share this optimism: Danube Properties’ Ghayyour Khan says the scheme creates “an opportunity for people who are just thinking but not able to buy” and that it is “good for the market and for the new customers.”

Overall, analysts see a positive market impact. The program is expected to inject thousands of new buyers into a booming market. Dubai Land Department projects roughly 5,000 additional first-time buyers (nationals and residents) will enter the market through this scheme in 2025 As one source put it, the initiative “opens the door to buyers who were previously sidelined,” encouraging them to become long-term property stakeholders By boosting homeownership, the city also builds community stability and sustainable demand. (For example, it aligns with Dubai’s “D33” vision to broaden homeownership and double economic output by 2033

Implementation Timeline and Outlook

On July 2, 2025, the First Home Buyer Program was officially announced. From that date, UAE residents have been able to register through DLD’s website or the Dubai REST app In this first phase, the plan is only open to people who live in Dubai (UAE nationals and expatriates). Majid Al Marri said that a second phase could later give benefits to buyers from other countries. The application process is fully digital: applicants submit basic info (age, Emirates ID, desired property type) online, then partner developers match them to units, and banks provide financing offers within a day

Dubai hopes that this program will have a real effect in the future. Authorities think that by the end of the year, around 5,000 new homeowners will have moved in. This surge would contribute toward the government’s target of AED 1 trillion in annual real-estate transactions by 203. Over time, more developers and lenders are expected to join, which will give people more options for projects. In sum, the initiative is designed to have both immediate and long-term effects: easing financing and pricing hurdles for first-time buyers now, while ultimately expanding Dubai’s base of property owners and supporting a resilient market.