According to announcements made after the 56th GST Council meeting in New Delhi, India will roll out a major overhaul of the GST on September 22, 2025. This will turn four slabs into a simpler two-rate structure of 5% and 18%. There will also be a special 40% band for certain luxury and “sin” goods. Most of the changes are meant to lower taxes on everyday items and make it easier for businesses to comply. The Council’s decisions, which were made unanimously and framed by the Finance Minister as being for the common man, will move hundreds of goods and important services into lower brackets. However, some categories will see increases or stay the same until legacy cess-linked borrowings are paid off.

What happens on September 22?

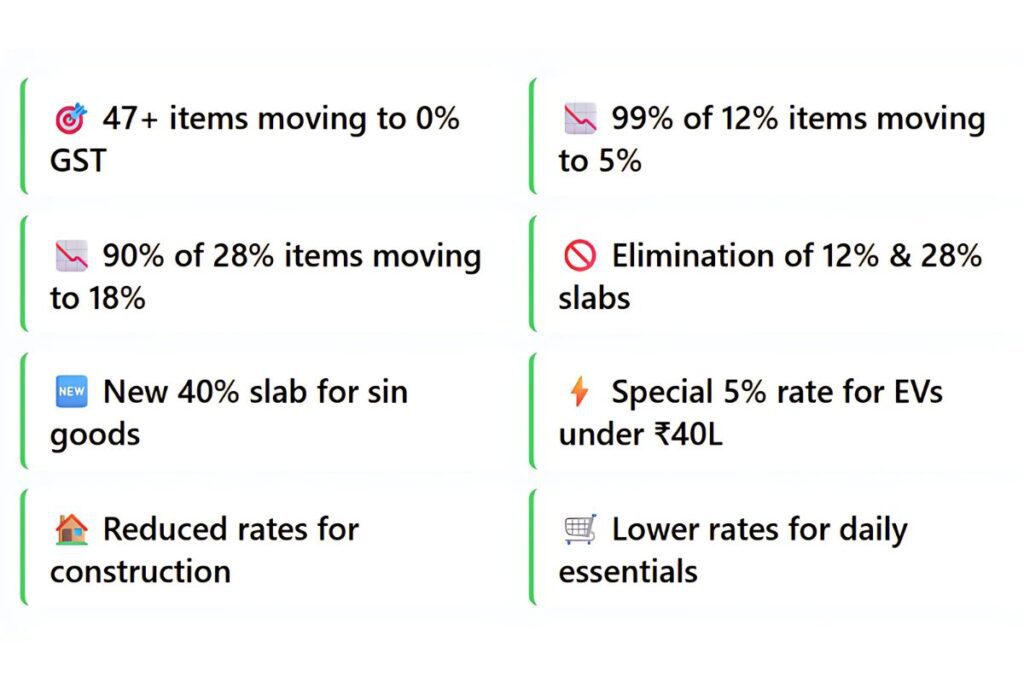

Starting on September 22, the current 12% and 28% slabs will be removed. Almost all goods and many services will be put into a two-tier system with a 5% (merit) rate and an 18% (standard) rate. This is the biggest change in rates since GST was introduced in 2017. A separate 40% slab has been approved for a small group of luxury and sinful goods, like sugary or caffeinated drinks and some high-end cars. However, tobacco products will stay at their current rates for a while longer until cess-linked loans are paid off. This will create a phased transition that was clearly explained in the post-meeting briefings.

Most of the rate cuts are aimed at everyday items like personal care products, packaged foods, shoes, clothes, small household goods, and a wide range of household supplies. These items will go from 5% to 18%, which the Council and several reports say should lower retail prices and boost demand as festivals approach. The simplification, which involved taking away two slabs and moving items down, also aims to cut down on disagreements and compliance issues that had been common under the previous four-rate system. This was a point that was brought up many times during the GST 2.0 framing.

Old vs new slabs

The government has set the effective date for the new structure as September 22, 2025, which coincides with the first day of Navratri, aligning the rollout with a key consumption period. Here is the core shift, in one glance.

- Old slabs: 5%, 12%, 18%, 28% plus compensation cess on demerit and luxury goods (introduced in 2017).

- New slabs: 5% and 18% for almost all goods and many services from September 22; a special 40% rate for designated sin and luxury items; tobacco products stay at existing rates and cess for now.

- Exceptions and phasing: Tobacco and related products continue at 28% plus compensation cess until cess borrowings and interest are fully repaid; their transition to the 40% framework will be decided subsequently.

Representative item shifts

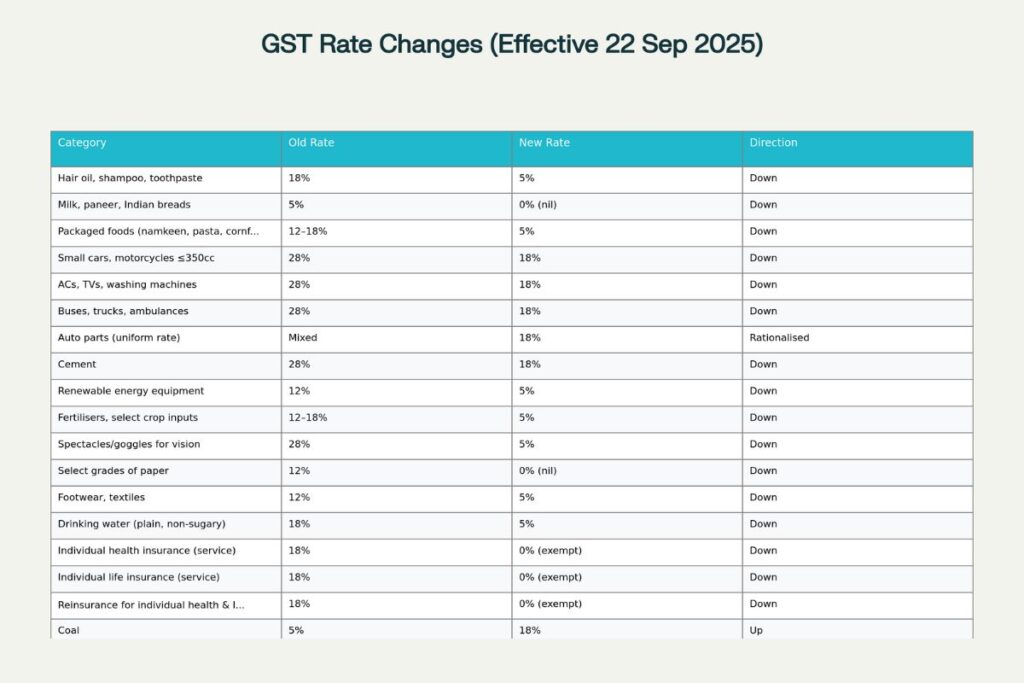

The table below pairs representative items with their previous GST rate and the new rate, indicating whether the tax burden falls or rises from September 22.

| Category / product | Old rate | New rate | Direction |

| Hair oil, shampoo, toothpaste | 18% | 5% | Down |

| Milk, paneer, Indian breads | 5% | 0% (nil) | Down |

| Packaged foods (namkeen, pasta, cornflakes, butter, ghee) | 12–18% | 5% | Down |

| Small cars, motorcycles ≤350cc | 28% | 18% | Down |

| ACs, TVs, washing machines | 28% | 18% | Down |

| Buses, trucks, ambulances | 28% | 18% | Down |

| Auto parts (uniform rate) | Mixed | 18% | Rationalised |

| Cement | 28% | 18% | Down |

| Renewable energy equipment | 12% | 5% | Down |

| Fertilisers, select crop inputs | 12–18% | 5% | Down |

| Spectacles/goggles for vision | 28% | 5% | Down |

| Grades of paper (select) | 12% | 0% (nil) | Down |

| Footwear, textiles | 12% | 5% | Down |

| Drinking water (no sugar/flavour) | 18% | 5% | Down |

| Coal | 5% | 18% | Up |

| Sugary/flavoured/caffeinated drinks | 28% | 40% | Up |

| Tobacco products (interim) | 28% + cess | No change (pending) | Unchanged |

Services GST: key changes

Starting on September 22, all individual health insurance and all individual life insurance will be exempt from GST. This will cut the current 18% tax burden and lower premiums directly. Many news outlets have reported on the Finance Minister’s announcement and industry estimates of significant savings. The exemption also applies to reinsurance of these individual health and life policies. This was done to make them more affordable and to get more people to sign up for them in areas where high out-of-pocket costs have kept people from doing so.

Reports from industry analysts say that retail health premiums could go down by about 15% in real terms. However, the exact benefit will depend on expense ratios and how quickly insurers change the prices of renewals across product lines in the 12–18 month window that is typical for these kinds of changes. Also, restaurants in certain locations will no longer be able to choose the 18% with input tax credit structure. This shows that the two-slab framework will make the hospitality industry more consistent and stricter.

The Council’s changes are not part of a separate service tax system; they are part of the GST-on-services system, which replaced the old “service tax” system in 2017. The main change this time is that insurance is no longer taxed. The government and businesses have framed the services recalibration as part of a larger effort to make things easier, along with lower prices on goods, to boost consumption, improve compliance, and lower the number of lawsuits.

What GST rates are not changing (for now)

Tobacco and related products, such as pan masala, gutkha, zarda, bidis, and cigarettes, will stay at their current GST rates and compensation cess rates until all cess-linked borrowings and interest are paid off. After that, these categories will move into the new 40% slab as they are notified. The Council’s announcements made it very clear that this sequence was important. This was because of budgetary limits on the compensation cess account, even though the overall structure is moving to two slabs.

The Council has also announced a change in valuation for some high-risk categories. They will now be valued based on the Retail Sale Price to stop leaks. This is an enforcement measure that goes along with the headline rate changes. In real life, even though many consumer goods are getting cheaper, the fact that demerit goods are getting more expensive and tobacco taxes are staying the same means that people in that group will have to be more careful and pay more taxes.

Why GST Cut now: background and timeline

On September 3, 2025, the GST Council met in New Delhi, led by Finance Minister Nirmala Sitharaman, to approve the rationalization. Many reports say that the decisions were made unanimously after a long meeting. During his Independence Day speech, Prime Minister Narendra Modi hinted at a move toward a simpler structure by calling GST 2.0 a next-generation reform that would make things easier for businesses and households.

Since GST started on July 1, 2017, the four-slab structure and layers of compensation cess have been criticized for being too complicated and having duty structures that are the opposite of what they should be. However, collections have grown as the base has grown. Policymakers are betting that a simpler system will lower classification disputes and boost consumption, especially during the holiday season, by combining two main slabs and singling out demerit and luxury items with a 40% rate.

The new rates will start on September 22, 2025, which is the first day of Navratri. Officials stressed this timing detail to show that the changes were meant to help consumers. As mentioned, items linked to tobacco are not included in the immediate shift. They will move later, after the compensation cess liabilities are settled, for which the Council gave specific authorizations on timing.

What gets cheaper

Based on the Council’s framework and published lists, a large set of daily-use goods will see lower tags, while some big-ticket durables move from the old 28% band to 18%. The following broad families are affected:

- Personal care and hygiene: hair oil, soaps, shampoos, toothbrushes, toothpaste, and similar items will be taxed at 5% instead of 18%.

- Packaged foods: namkeen, bhujia, sauces, pasta, cornflakes, butter, ghee, and assorted staples will cluster at 5%, down from 12–18% earlier.

- Essential foods: UHT milk, chhena, paneer, and Indian breads move to nil, removing GST entirely on these staples that had previously paid 5%.

- Consumer durables: entry-level appliances such as ACs, TVs, refrigerators, and washing machines migrate from 28% to 18%.

- Mobility: motorcycles ≤350cc, small cars, three-wheelers, as well as buses, trucks, and ambulances align at 18%, down from the 28% band.

- Inputs and infrastructure: select construction materials shift down, with cement explicitly set to 18% from 28%; renewable energy equipment and many farm inputs, including fertilisers, drop to 5%.

Education items – including notebooks, pencils, and related learning aids – see nil or 5% rates across categories, lowering school-related outlays for families, according to summaries carried by multiple outlets. For packaged drinking water and similar non-flavoured, non-sugary waters, the rate dips to 5% from 18%, narrowing a previously notable cost gap for everyday hydration products.

What Products get costlier

Two big increases stand out: sugary, flavored, and caffeinated drinks go from 28% to 40%, which fits with the public health reasons usually given for “sin tax” baskets. In addition, the price of coal goes up from 5% to 18%, which could make things more expensive for industries that rely on coal and change the relative costs of inputs in the power and heavy industry sectors.

Tobacco products don’t change rates right away, but they stay high under the current system with the compensation cess in place. When they finally move to 40%, they will still be a heavy burden even after the cess ends. Through an RSP basis, an anti-leakage measure, valuation will also get stricter for some demerit and related goods. This can effectively raise the realized tax incidence even if the headline rate stays the same.

Insurance: GST exemption and likely effects

Starting on September 22, all individual health and life insurance policies, including term, ULIP, endowment, family floater, and senior-citizen plans, will no longer have to pay GST. This is a big change from the current 18% tax. Reinsurance for these individual policies is also not subject to the tax. This is done to pass on the savings through the pricing chain and avoid cost add-backs that could lessen the benefit.

According to media reports, HSBC analysts think that the effective out-of-pocket cost of health insurance will go down by about 15%. However, this will vary depending on the insurer’s expense ratios and will take 12 to 18 months to fully take effect for new policies. Several reports say that the Centre has made it clear that it expects insurers to pass on benefits. Some states have also raised concerns about short-term revenue losses from changes to goods and services.

Industry impact: who gains, who adjusts

Lower taxes on personal care and kitchen staples should help FMCG and packaged foods grow in volume and reach more people, especially in rural and semi-urban areas. Business media sources say that discretionary spending could pick up as household budgets get tighter. Leaders in biscuits and personal care say that lower prices on shelves usually lead to quick demand response.

As effective prices drop from 28% to 18%, consumer durables, especially entry-level TVs, air conditioners, refrigerators, and washing machines, could see renewed interest. This is a big change before the holiday season. Auto makers can benefit in two ways: smaller cars and two-wheelers (≤350cc) get an 18% rate, while commercial vehicles like buses and ambulances go down. A uniform 18% on auto parts could also make supply chains and aftersales pricing less complicated.

Construction and real estate could get a mix of good and bad news. For example, cement prices dropping by 18% could lower a major input cost, and some construction materials dropping in price and renewable energy equipment at 5% could make it easier to build green buildings and infrastructure. Healthcare benefits twice: first, patients and families don’t have to pay as much for life-saving drugs and devices because they don’t have to pay GST on individual health and life insurance. This is important because out-of-pocket costs have been high in this area.

On the other hand, industries that use a lot of coal will have to deal with higher costs as the GST rate goes from 5% to 18%. Companies that make sugary or caffeinated drinks will have to deal with a 40% GST. These changes will likely lead to changes in the mix of products, reformulation, or pricing strategies over time. Tobacco products are still very common, and the current rates and cess don’t help. Stricter valuation rules make it even harder to comply, even before they move to the 40% slab.

Common man benefits

The most immediate relief for families is simple: the GST on a long list of everyday items, like hair oil, soap, shampoo, toothpaste, toothbrushes, tableware, cookware, and staples, goes down a lot. This should be clear in store bills after September 22. Packaged foods will go up to 5%, while basic foods like milk, paneer, and Indian breads will go down to nothing. This is meant to lower monthly grocery costs, which is where people are most sensitive to price changes.

The price of small appliances and electronics, like TVs and washing machines, goes from 28% to 18%, which makes them cheaper. This, along with discounts during the holidays, could lead to even bigger savings during Navratri and Diwali shopping. According to the Council’s reasoning and what industry experts have said, making individual health and life insurance GST-free directly lowers the cost of protection, making it easier for people to get it and encouraging first-time buyers and upgrades.

Revenues, risks, and reassurance

While rate cuts usually slow down revenue in the short term, policymakers and analysts often point to historical rebounds as compliance improves and volumes rise. This is also true in reports that talk about previous rounds of rationalization and the weighted average GST rate going down over time. That being said, some states have publicly guessed at possible losses. For example, a minister from West Bengal mentioned a drop in revenue at first. This is why the Council agreed on reform with careful phasing for tobacco and a focus on enforcement in sin categories.

According to SBI Research, which was reported by business media, states could still be net gainers after devolution and SGST shares are taken into account, even if headline rates go down. However, balancing consumer relief with fiscal prudence will require close monitoring of collections through FY26. The Centre has made it clear that its three main goals are to make things easier, to make it easier for people to follow the rules, and to support demand. In the larger GST 2.0 story, there has also been talk of tools like pre-filled returns and faster refunds.

How businesses should prepare

By September 22, retailers, distributors, and manufacturers will need to update their ERP systems, price lists, labels (if they apply), and point-of-sale settings to show the new 5% and 18% rates, as well as the new 40% category for certain goods. Hospitality chains that were subject to the 18% with ITC option that was taken away need to review their billing and input credit planning. Sellers of sin or luxury goods should also review their RSP valuation and documentation to make sure they are in line with anti-leakage measures.

Analysts say that insurers will quickly start offering zero-rated treatment for individual health and life products, including reinsurance arrangements. They will probably start gradually raising the prices of renewals over the next year to year and a half. In the meantime, policymakers have publicly called for clear communication of pass-through benefits, which will be very important to make sure policyholders get the help they need.

The bottom line

GST 2.0 has two slabs for most goods and services, a separate 40% for sin and luxury goods, and a clear focus on basic household costs. The Council’s unanimous approval sets up a nationwide reset on September 22. This will include cuts in rates for personal care, food, education supplies, white goods, and key inputs, as well as a major change in services: GST-free individual health and life insurance.

What stays the same, at least for now, are tobacco rates and cess. This is because there are fiscal guardrails around legacy compensation borrowing. Policymakers are trying to make the system simpler and more growth-oriented. For both consumers and businesses, the first step is to get ready for the new rate map, pay attention to the exceptions, and use this time of year, when prices are lower and access is easier, to put policy into action.